Agentic Insurance Update: October 2025

Share:

At Counterpart, we believe modern insurance should work for you—not the other way around. That’s the promise behind Agentic Insurance™: a new operating system for underwriting, broker services, risk mitigation, and claims management that brings together intelligent automation and deep insurance expertise. This blog post details a few of the tools and technologies that Counterpart is leveraging to improve service, speed, and consistency across our platform. Check out our Agentic Insurance blog for more.

Your Shortcut to Smarter Applications

At Counterpart, we’re building the future of underwriting: intelligent, adaptive, and always one step ahead. That’s the vision behind Agentic Insurance™. Today, we’re introducing the Expiring Policy Extractor, a powerful new tool that reads expiring policies and sets up the next quote in seconds.

The Problem with Manual Applications

When a submission includes an expiring policy, that document contains everything our underwriters need, like dates, terms, limits, and endorsements. But extracting that information is slow and manual. Underwriters and Risk Engineers often have to dig through pages just to recreate what’s already there.

Enter the Expiring Policy Extractor

Now live in the Counterpart Digital Application, this AI-powered extractor reads expiring declarations pages, so you don't have to input existing policy and endorsement information. It cuts application time and reduces rekeying errors.

How It Works

- Upload expiring declaration pages from prior policies.

- Our AI extracts dates, terms, pricing, sub-coverages and more.

- Submit your application and get faster, more accurate quotes from our underwriting team.

Why It Matters

- 30%+ of ML & PL submissions include prior policies. Now they move faster.

- Improved accuracy means less back-and-forth with brokers.

- Built-in intelligence powers downstream decisions (like sub-coverage logic).

- Speed to quote improves dramatically.

- No extra tools needed, just upload and go.

Where You’ll See It

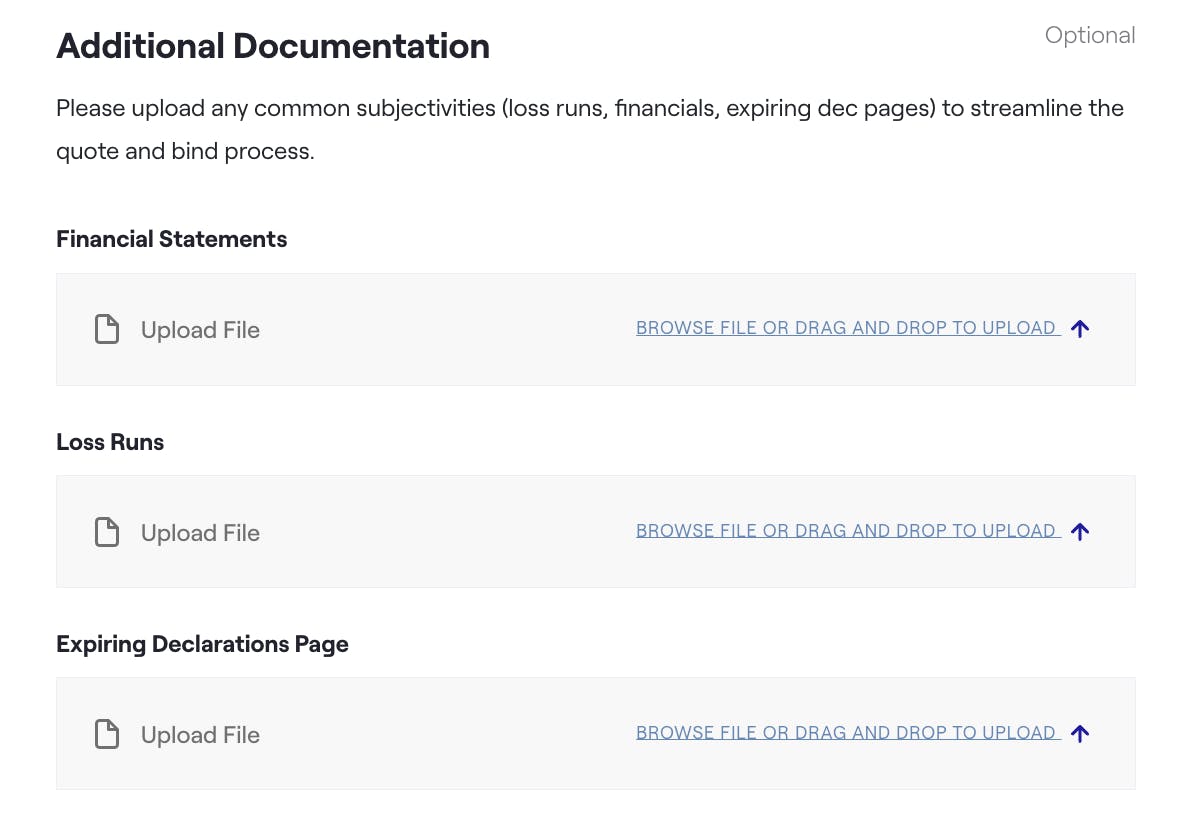

- Counterpart’s Digital Application → Upload the expiring policy and the extractor will automatically pull the details needed for a fast, accurate quote. You can find it in the Additional Documentation section next to the Financial Statement Extractor and Loss Run Extractor.

- Email Submissions → For email submissions, our underwriting team uses the extractor internally to reduce manual entry and improve accuracy.

Reimagining Submission Workflows

This launch is another leap forward in our Agentic Underwriting™ journey. We are bringing intelligence to the workflows you use every day. By unlocking data from the documents you already have, we’re making submissions smarter and faster.

Start your next quote with just a PDF, and let the Expiring Policy Extractor do the rest.

Share: